Managing money wasn’t always easy for me.

Like many, I struggled to keep track of my spending, save consistently, and figure out how to invest.

That’s when I turned to technology for help. Over the years, I’ve tried various financial apps that transformed my money habits and helped me reach my financial goals.

This article will walk you through the 10 best financial apps that can help you set goals, create a budget, invest wisely, and track your progress.

I’ll share my personal experiences, detailed app features, and tips to get started with each one.

1. Mint: Your All-in-One Budgeting Companion

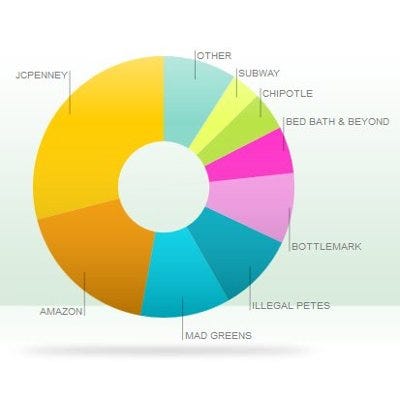

Mint was a game-changer for me. It provides an easy way to track expenses and create budgets in one place.

Key Features:

- Connects to bank accounts and credit cards.

- Automatically categorizes your transactions.

- Sets spending limits and sends alerts when you’re close.

How I Use It:

Mint’s dashboard showed me exactly where my money went, from groceries to subscriptions. It helped me cut down on unnecessary expenses and save for a vacation.

Steps to Get Started with Mint:

- Download the Mint app from the Google Play Store or Apple App Store.

- Sign up with your email or log in using your Intuit account.

- Connect your accounts by securely linking your bank, credit card, and loan accounts.

- Set goals like saving for a vacation or paying off debt.

- Review categorized expenses in the dashboard to identify spending patterns.

2. YNAB (You Need a Budget): Master Your Budget

When I got serious about taking control of my finances, YNAB became my favorite. This app focuses on proactive budgeting and assigns every dollar a purpose.

Best Features:

- Helps you plan ahead for irregular expenses.

- Tools for faster debt repayment.

- Real-time syncing with your partner or family.

Why It Works:

YNAB taught me to plan for big goals like buying a car. Their educational resources also made me more financially literate.

Steps to Get Started with YNAB:

- Download the YNAB app and sign up for a 34-day free trial.

- Add your income and recurring expenses like rent, bills, and groceries.

- Use the “Give Every Dollar a Job” feature to allocate funds to specific categories.

- Sync your accounts for real-time updates or enter transactions manually.

- Explore the YNAB educational tutorials for budgeting tips.

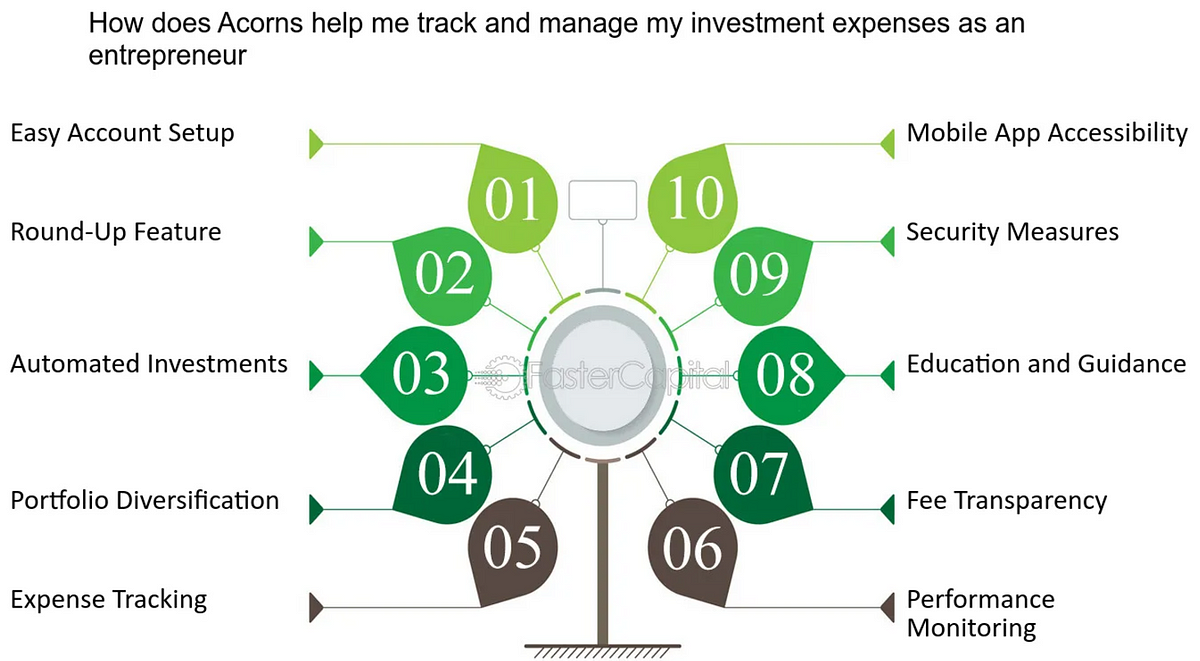

3. Acorns: Invest Your Spare Change

Investing always intimidated me until I discovered Acorns. It rounds up your purchases and invests the spare change into diversified portfolios.

Highlights:

- Automatic micro-investments.

- Portfolios designed by financial experts.

- Sustainable investment options.

My Experience:

I started small, and within a year, my Acorns account grew to over $500 — effortless saving at its best!

Steps to Get Started with Acorns:

- Download the app and create an account.

- Link your bank account and set a round-up option (e.g., round $4.50 to $5 and invest $0.50).

- Choose an investment portfolio based on your risk tolerance (conservative to aggressive).

- Set up recurring deposits to grow your account faster.

- Use the Acorns Grow feature to access financial education resources.

4. Robinhood: Simplified Stock Trading

Robinhood was my gateway into stock trading. It’s beginner-friendly and doesn’t charge commissions.

Features:

- Fractional shares starting at $1.

- Real-time market updates.

- Access to cryptocurrencies and ETFs.

Pro Tip:

Use Robinhood to learn the basics of trading, but don’t put all your money into risky stocks. Start with small amounts to test the waters.

Steps to Get Started with Robinhood:

- Sign up on the Robinhood app or website.

- Verify your identity by uploading your government-issued ID.

- Link your bank account to fund your Robinhood account.

- Browse stocks, ETFs, or cryptocurrencies using the search bar.

- Start investing with as little as $1 by purchasing fractional shares.

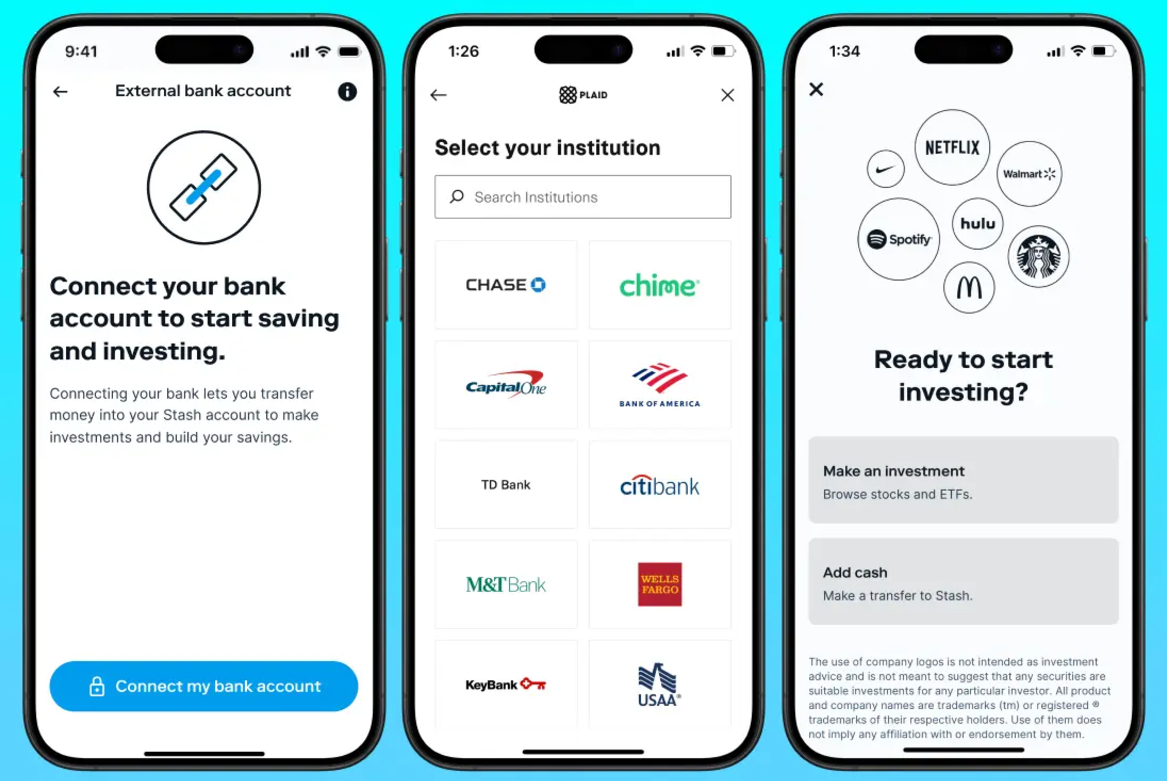

5. Stash: Learn and Invest Simultaneously

Stash combines investing with education, making it perfect for beginners.

Key Features:

- Personalized guidance based on your goals.

- Stock-back rewards for spending.

- Low entry point with just $5.

Why I Love It:

Stash helped me understand the importance of diversification. Its bite-sized lessons were a bonus.

Steps to Get Started with Stash:

- Download the app and sign up with your email.

- Take the risk tolerance quiz to receive tailored portfolio suggestions.

- Fund your account with a minimum of $5.

- Use the Learn section to access financial tips and strategies.

- Activate the Stock-Back® Card to earn stocks while shopping.

6. PocketGuard: Stop Overspending

PocketGuard helped me understand where my “extra” money went. It shows you how much you can safely spend after accounting for bills and savings.

Best Features:

- Tracks recurring subscriptions.

- Real-time updates on spending power.

- Links to all financial accounts for easy tracking.

How It Helped Me:

It gave me confidence to spend guilt-free while ensuring I was saving enough.

Steps to Get Started with PocketGuard:

- Create an account and link your bank accounts.

- Add recurring bills, subscriptions, and savings goals.

- Review the “In My Pocket” feature, which shows how much money is left after commitments.

- Use the subscription tracker to cancel unnecessary services.

- Monitor your spending habits via the app’s insightful charts.

7. Personal Capital: Your Financial Snapshot

When I needed a complete overview of my finances, Personal Capital was my go-to.

Why It Stands Out:

- Tracks net worth, expenses, and investments.

- Offers retirement planning tools.

- Monitors portfolio performance.

Personal Tip:

Use this app if you’re juggling multiple accounts. It simplifies everything into one clear dashboard.

Steps to Get Started with Personal Capital:

- Sign up for a free account and connect all financial accounts.

- Review your net worth, including assets and liabilities.

- Explore the retirement planner to calculate how much you need to save.

- Analyze your investment portfolio for risk and diversification.

- Access detailed reports on spending, cash flow, and savings.

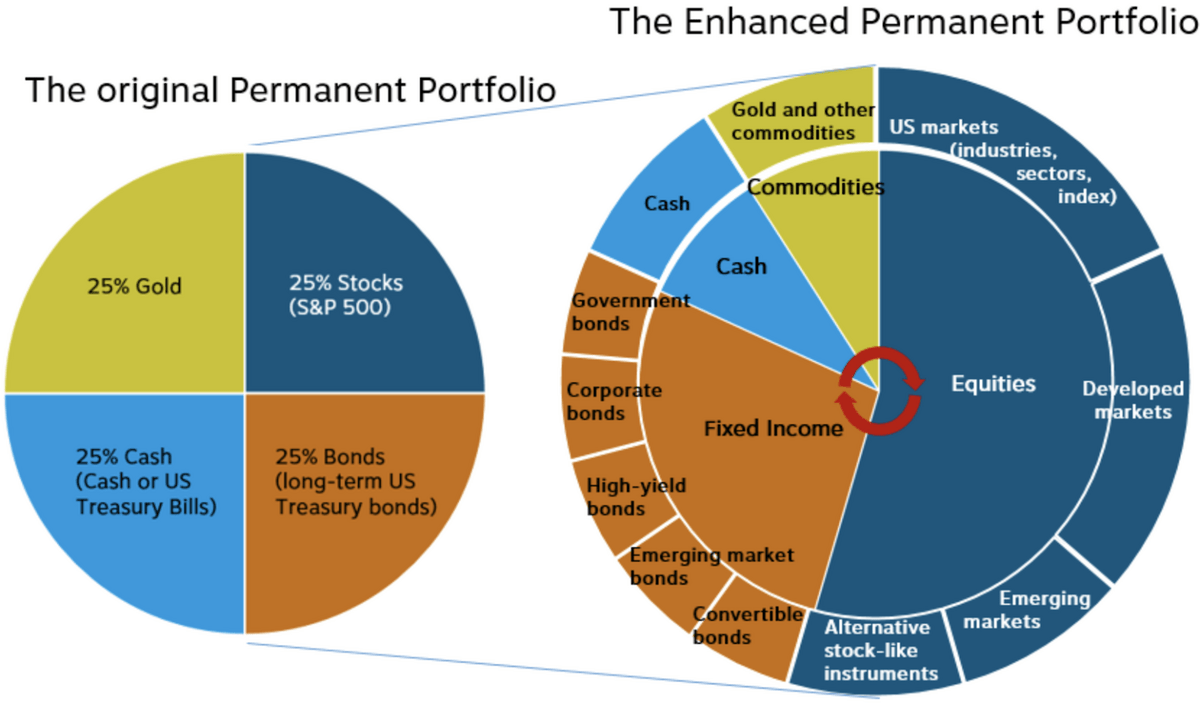

8. Wealthfront: Automated Investment Planning

Wealthfront is ideal if you want a hands-off investing experience. It manages your portfolio and aligns it with your long-term goals.

What I Love:

- Offers tax-saving features.

- Low management fees compared to traditional advisors.

- Goals-based planning, like saving for a home.

My Advice:

Wealthfront made investing stress-free. I recommend it for those who want to focus on other priorities while building wealth.

Steps to Get Started with Wealthfront:

- Sign up and answer a risk assessment questionnaire.

- Transfer funds to open an account (minimum $500).

- Choose goals like retirement savings or buying a home.

- Wealthfront automatically invests your money in diversified portfolios.

- Activate the tax-loss harvesting feature to maximize savings.

9. Goodbudget: The Envelope System Reimagined

Goodbudget brought the classic envelope budgeting system into the digital age.

Features I Like:

- Allocates money into virtual “envelopes.”

- Tracks spending manually for better awareness.

- Syncs across multiple devices.

How It Helped Me:

This app is fantastic for people who prefer manual tracking and want full control over every dollar spent.

Steps to Get Started with Goodbudget:

- Create an account and download the app.

- Set your monthly income and create virtual envelopes for categories like groceries and entertainment.

- Manually record transactions to track spending.

- Adjust your envelopes as needed to meet financial goals.

- Share budgets with family members using the multi-device sync feature.

10. Clarity Money (Marcus Insights): Cancel Subscriptions and Save

Clarity Money helped me clean up unnecessary expenses and stay organized.

Why I Recommend It:

- Identifies recurring subscriptions.

- Provides insights to improve saving habits.

- Simple, clutter-free interface.

Pro Tip:

Use it to cancel services you no longer need — it saved me $300 in the first month.

Steps to Get Started with Clarity Money:

- Download the app and link your financial accounts.

- Review recurring subscriptions and cancel unnecessary ones.

- Set up weekly or monthly savings deposits.

- Track spending trends to identify areas for improvement.

- Use insights to plan a more efficient budget.

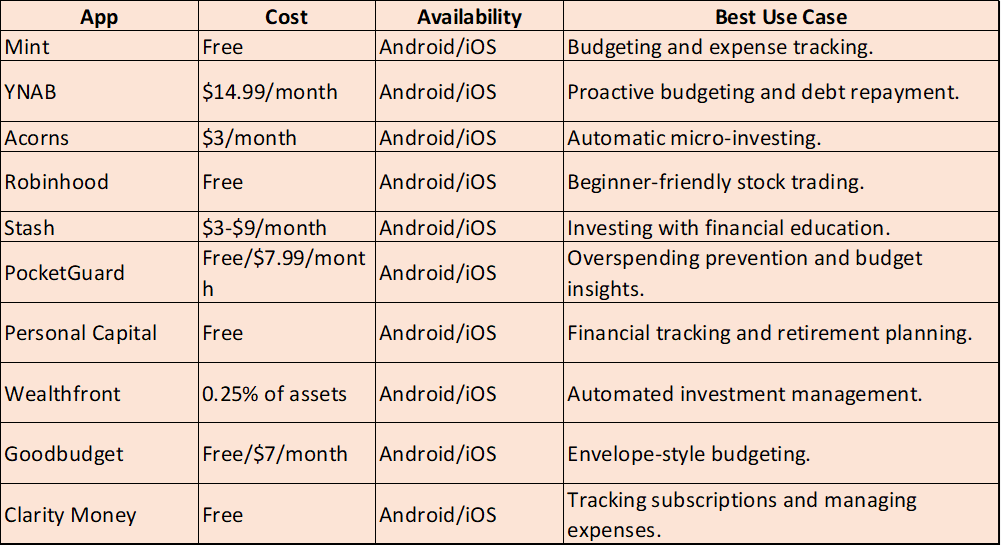

Comparison Table of Financial Apps

Testimonials and User Stories

These apps aren’t just tools; they’re life-changing resources that have helped real people achieve their financial dreams. Let’s explore some inspiring stories:

- Sarah’s Micro-Investing Journey: Using Acorns, Sarah saved $1,200 in just six months. “It feels effortless,” she says. The app rounded up her daily purchases and invested the spare change, making saving and investing a seamless part of her daily life.

- John’s Debt-Free Mission: Struggling with mounting debt, John turned to YNAB (You Need A Budget). By assigning every dollar a job, he managed to reduce his debt by 50% in a year. “It gave me clarity and control over my finances,” he shares, emphasizing how the app’s proactive approach changed his perspective on money.

- Emily’s Budgeting Revelation: Emily used Mint to uncover hidden costs in her budget. By identifying unnecessary subscriptions, she saved $300 annually. “I never realized how much those small charges added up until Mint broke it down for me,” she explains.

These stories show that with the right tools, anyone can take charge of their finances, whether it’s saving, investing, or managing debt. Let these real-life experiences inspire you to start your financial journey today!

Tips for Choosing the Right App

Not sure which app suits you best? Here’s some advice:

- If you’re new to budgeting: Start with Mint for its intuitive and beginner-friendly interface.

- Want to save and invest effortlessly? Acorns is perfect for automated micro-investing.

- Looking to manage debt? YNAB offers tools to help you tackle your financial obligations systematically.

- Interested in stock trading? Robinhood simplifies trading and offers educational resources for beginners.

Latest Updates or Features

Many of these apps continue to improve and innovate. Here are some recent updates:

- Robinhood: Recently added a 4.9% APY cash account, allowing users to save while trading.

- Mint: Introduced a bill negotiation feature to help users reduce recurring expenses.

- Wealthfront: Enhanced its Path tool, enabling users to plan for short-term goals like vacations or weddings.

- Stash: Launched “Smart Portfolios,” an automated investing option tailored to user preferences.

Security Tips for Using Financial Apps

Your financial safety is critical. Here are some tips to secure your accounts and understand how these apps protect user data:

- Enable two-factor authentication on all financial apps.

- Avoid public Wi-Fi when accessing your accounts. Use a secure home network or mobile data instead.

- Review permissions before linking your bank accounts to ensure apps only access necessary data.

- Check encryption policies: All the listed apps use bank-level encryption to safeguard your financial information.

- Create strong passwords: Use unique and complex passwords, and consider using a password manager for added safety.

Frequently Asked Questions

- What is the best app for beginners who want to budget and save money?

For beginners, Mint is an excellent choice. It’s free, user-friendly, and helps you track your expenses and set up savings goals effortlessly. - Are these financial apps safe to use?

Yes, all the apps mentioned use bank-level encryption and security features to protect your data. To stay secure, enable two-factor authentication and avoid accessing your accounts on public Wi-Fi. - Which app is ideal for someone who wants to start investing with small amounts?

Acorns is perfect for micro-investing. It rounds up your daily purchases to the nearest dollar and invests the spare change automatically. - Can I use more than one app at a time?

Absolutely! Many users combine apps to manage their finances holistically. For example, you can use Mint for budgeting and Robinhood or Stash for investing. - What is the cost of using these apps?

Some apps, like Mint and Personal Capital, are free. Others, like YNAB and Stash, charge a monthly or annual fee. Refer to the comparison table in this article for a detailed breakdown. - Do these apps work on both Android and iOS?

Yes, all the apps listed in this article are available on both Android and iOS platforms, ensuring compatibility with most devices. - How do I know which app is right for me?

It depends on your goals. If you want to budget, start with Mint. For debt repayment, try YNAB. If investing is your goal, apps like Acorns and Robinhood are great choices. Refer to the tips section in this article for more guidance.

Got more questions? Drop them in the comments, and I’ll be happy to help!

Conclusion

These apps are powerful tools to transform how you manage your finances. Whether you want to budget, save, or invest, there’s an app tailored to your needs. By following the step-by-step instructions, using the tips to choose the right app, and staying secure, you’ll be well on your way to achieving your financial goals.

- Which app do you use to manage your finances?

- Have you tried any of the apps mentioned in this article?

Share your experiences in the comments below. Your story might inspire someone else to take control of their financial journey.

If you’re curious about a specific app not listed here or want a detailed review of any particular tool, let me know! I’d be happy to research and provide the information you need. Your feedback and questions are always welcome!

Comments

Post a Comment